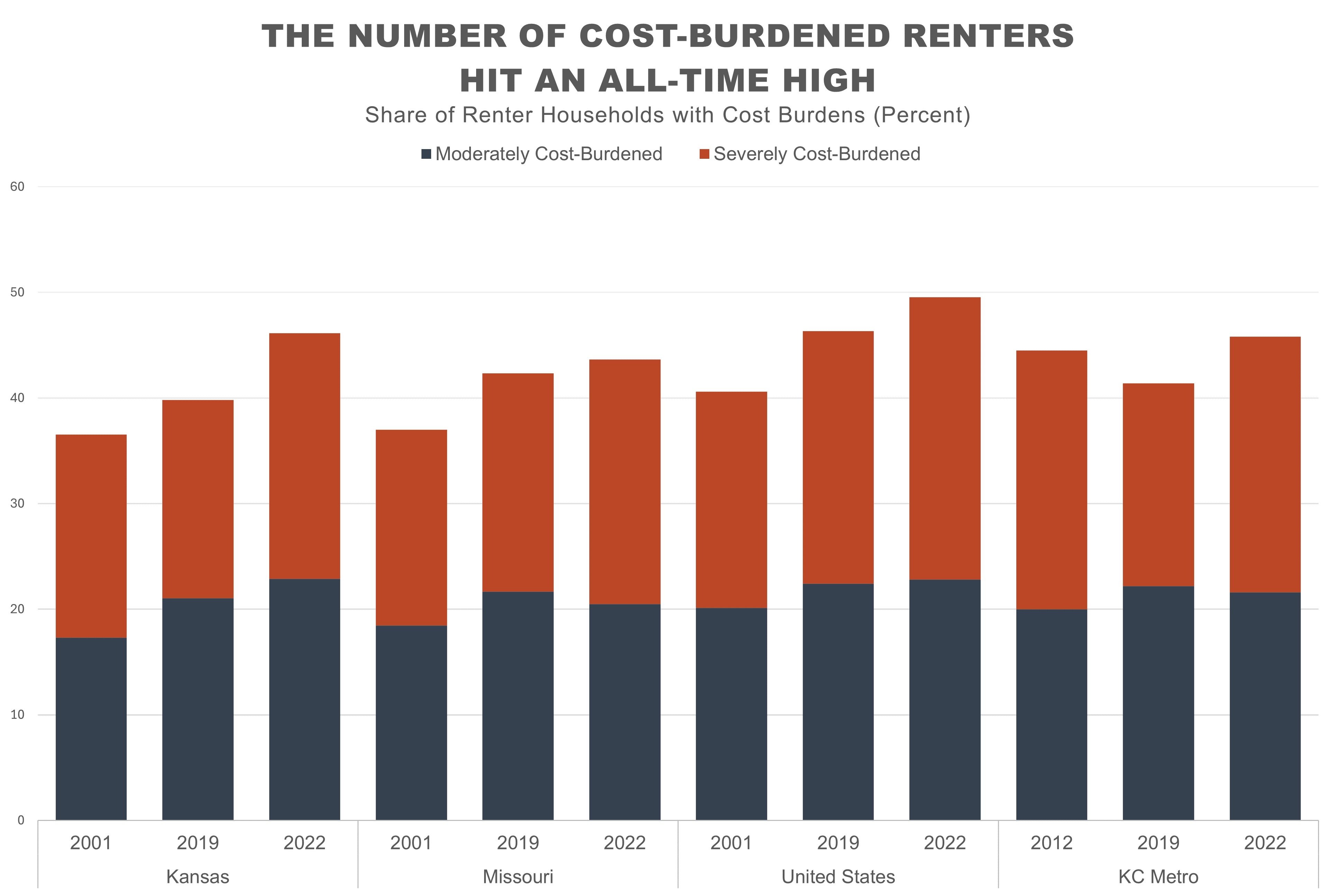

Over 50% of renters in the United States are now considered cost-burdened, according to a new report from Joint Center for Housing Studies of Harvard University (JCHS). Cost burden means households are paying 30% or more of their monthly income on rent. This is a 3% increase from 2019 and is largely driven by middle-income households paying higher rents. For households making between $45,000 and 74,999, cost burden increased by 5.4% between 2019 and 2022.

Data Source: America’s Rental Housing 2024, Joint Center for Housing Studies of Harvard University, Table W-14

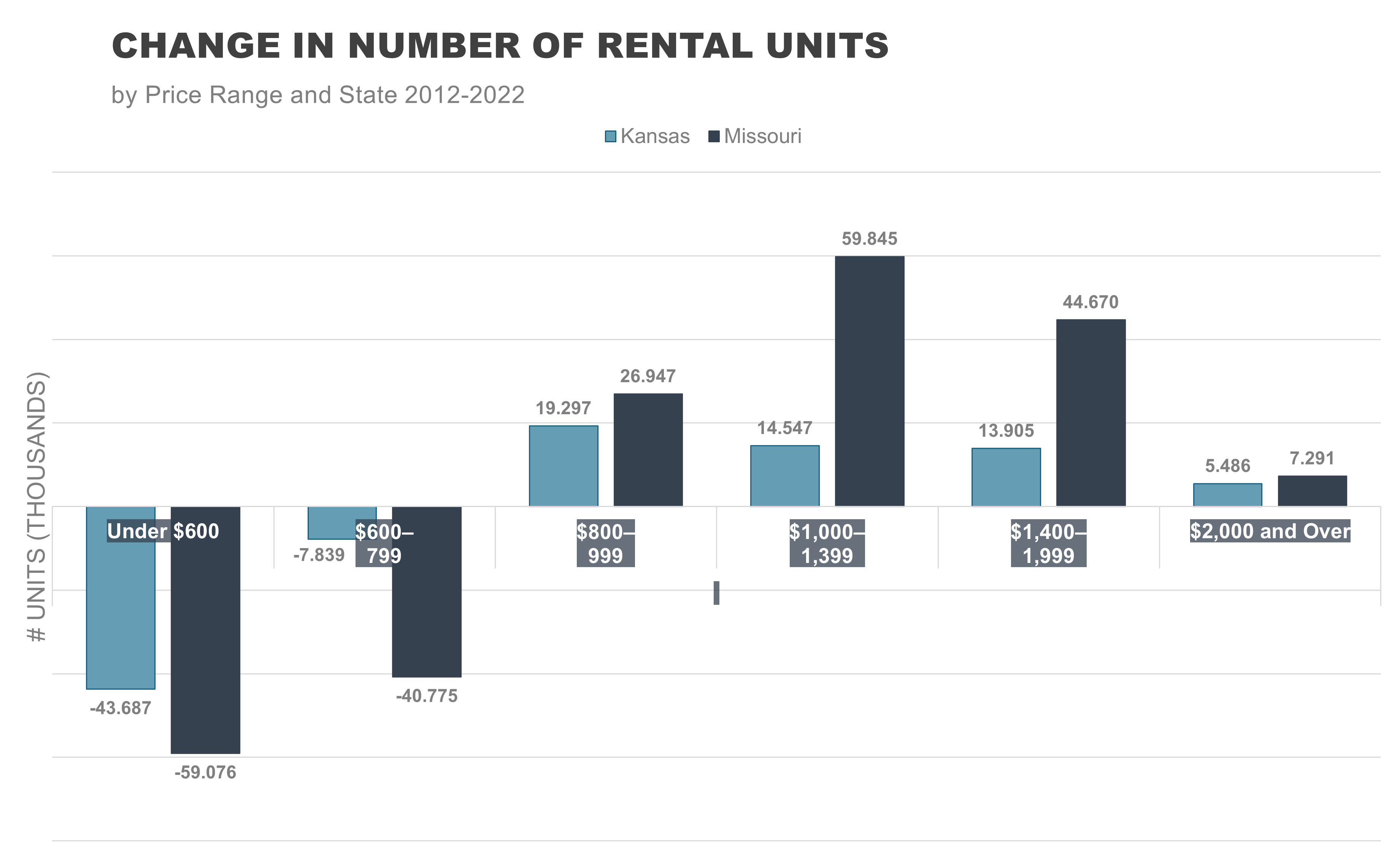

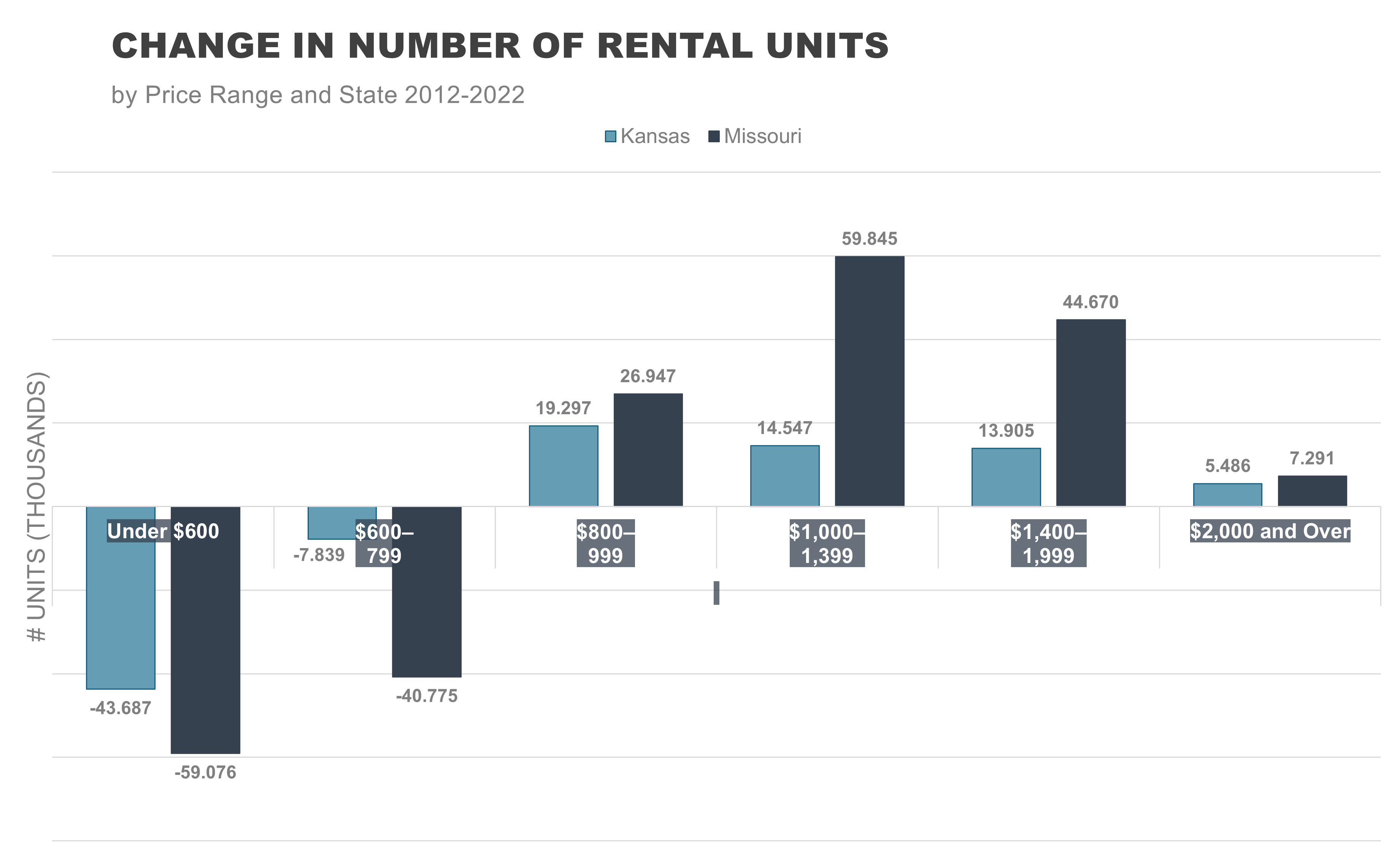

The impact of rising rents is particularly difficult for low-income households where the number of available units in an affordable price range continues to decline. Households making less than $24,000 per year account for 26% of all the nation’s renters, according to the report. Between 2012 and 2022, the nation lost over 2.1 million, or 23%, of units renting for under $600 per month. Units renting for $600 per month fell 28% in Kansas and 20% in Missouri in the same period. Over the last decade, units renting for over $1,000 per month increased 92% in Missouri and 44% in Kansas.

Data Source: America’s Rental Housing 2024, Joint Center for Housing Studies of Harvard University, Table W-18, W-29

Rents are rising and incomes are lagging nationally and in the Kansas City region. Cost-burdened households have less residual income (the amount left after paying rent and utilities) and subsequently spend less money on food and health care than non-burdened households. Though wages have risen in the region following the pandemic, wage increases are slower and lower than peer metros. Cost burden generates housing insecurity. According to the JCHS report, “people experiencing homelessness in unsheltered locations” across the nation was the highest ever recorded at 256,610 in 2022.

Data Source: America’s Rental Housing 2024, Joint Center for Housing Studies of Harvard University, Page 4

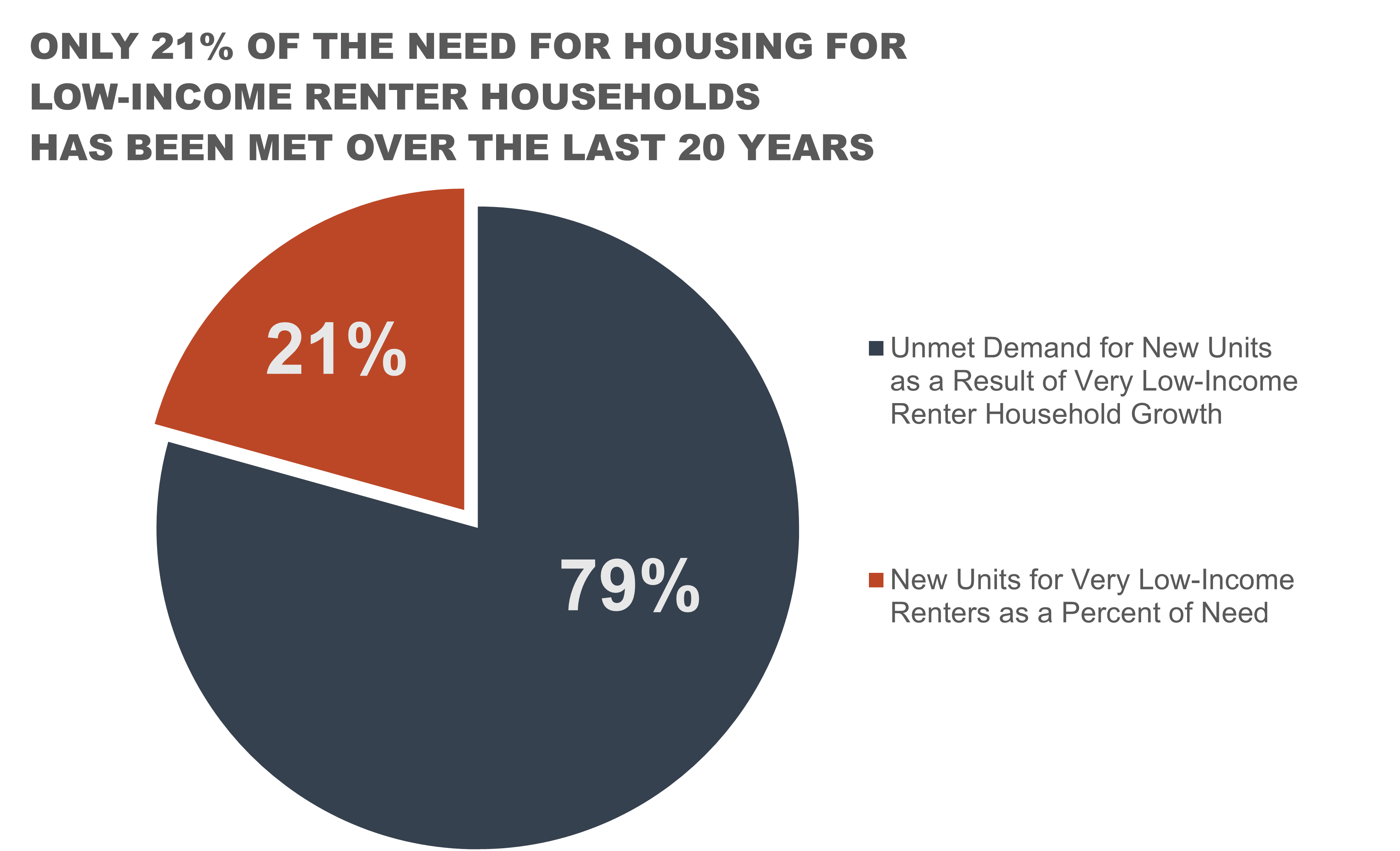

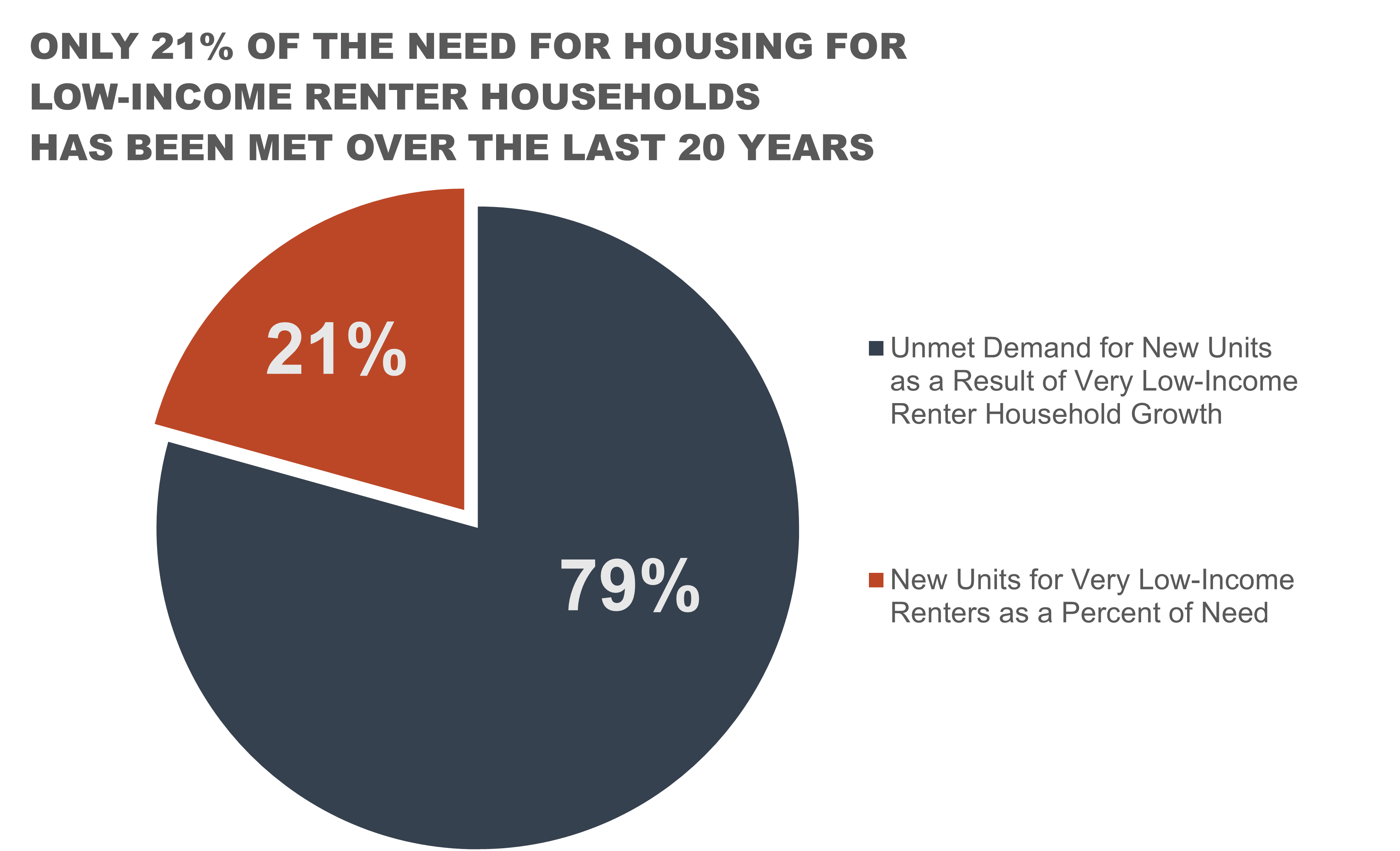

Over the past 20 years, the nation added 910,000 units of low-income housing, far below the need generated by an increase of 4.4 million low-income renter households over that time. MARC’s previous research identified a gap of 64,000 affordable housing units in the Kansas City region. In addition, the region could lose almost 11,000 units of affordable housing as contracts for Low-income Housing Tax Credits (LIHTC) expire. LIHTC is a federal program that incentivizes the development of low-income housing.

The Kansas City region has long touted affordability as a competitive advantage. Recent trends, particularly rising home prices, accelerating rents, and slow growth in wages are creating challenges for area communities. Last year, the region had the third-highest rent growth among peer metros. How the region addresses these issues will be key to maintaining and attracting new economic opportunities. For those interested in exploring the data, a number of interactive maps and tools were released as part of the JCHS America’s Rental Housing 2024 report that allow you to explore national and statewide trends. You can also download data supporting the JCHS research, which was used in the data visualizations in this piece. In addition, MARC has built and maintains a regional housing data hub and accompanying data stories and analysis of regional housing data, issues, and trends at marc.org/housing.